Trade Better, Smarter, Faster.

RejoiceFX’s Algo Trading empowers you to automate strategies with precision, transforming your trading into a seamless experience.

Algo Trading

Algo trading harnesses advanced algorithms to execute trading strategies with unparalleled precision, catering to traders seeking to customise their approach for a tailored trading experience. This innovative trading form allows individuals to leverage broker-provided API keys, granting access to automated operations that transform complex strategies into seamless actions. Algo trading, gaining momentum for its ability to simplify trading through technology, enables even those without programming skills to participate effectively. Traders can back-test strategies confidently, ensuring their moves are both smart and strategic. As Algo trading becomes increasingly popular, it represents the future of trading, offering a platform where strategies are not just executed but optimised, marking a significant shift in how trading success is achieved and redefining opportunities in the financial markets.

Advantages of Algo Trading

Fast Execution of Orders

Experience lightning-speed trading with high-frequency algorithms, executing thousands of trades per second for optimal performance.

Automation

Enjoy seamless, automated trading with pre-programmed algorithms that handle everything from monitoring to execution, eliminating the need for human intervention.

Risk Management

Algo trading integrates strategic risk management by automating entry/exit points, stop-loss, and fund rebalancing, reducing emotional trading decisions.

Human Error Reduction

Avoid costly mistakes like wrong inputs or forgotten stop-losses, as algo trading ensures precise, flawless execution without human error.

Cost Reduction

While setup costs can be high, algorithmic trading cuts long-term operational expenses and reduces transaction costs for efficient trading.

Free Algo Trading Software

Stay agile with free algo trading software that allows you to modify algorithms in real-time, adapting to changing market conditions.

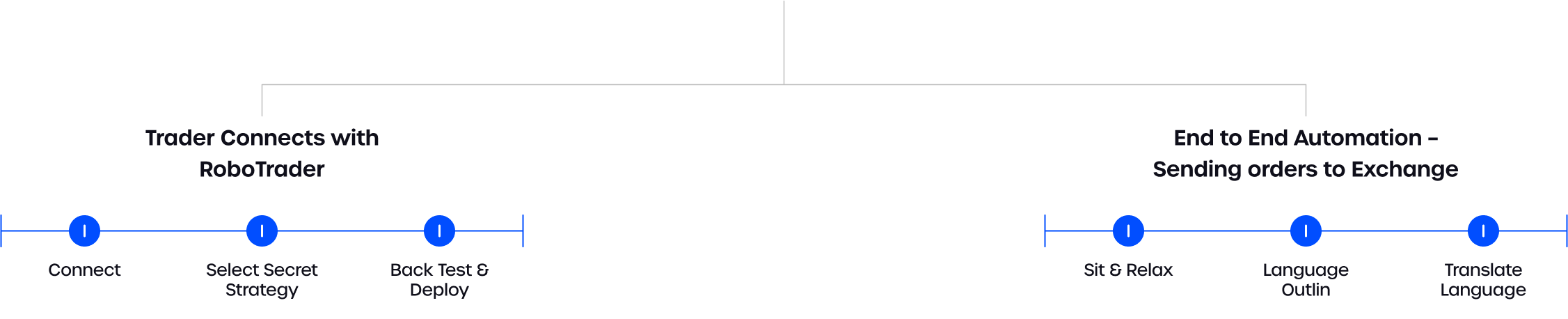

Our Algo Trading eco System

Simply Connect Your Trading with Powerful Algorithms

Best trading strategies

When it comes to trading strategies, there are thousands of trade systems are available on the internet and they all work on specific market conditions.

Backtesting

Algorithmic trading is a form of automated investing that lets you test out strategies before putting real money on the line. This gives traders invaluable insight into whether or not their strategy will work.

Elimination of Emotions

To minimize the emotional strain on traders, automated trading systems keep their emotions in check and allow them to follow a strategy more easily.

Plug and Play

Automated trading is programmed to conduct trades on your behalf according to predetermined conditions by EA’s and automatically updated in real-time.